Don't shy away from the task if you are a remote IT professional dealing with W-8 forms complexity. Instead, begin your journey to a solution by reading our previous article about the importance of form submission. After, simplify your filling process by reading the detailed instructions below.

To summarize, the W-8 form is an Internal Revenue Service (IRS) tax form whose primary goal is to clarify how much tax (if any) you are required to pay to U.S. tax authorities as an international contractor. There are five W-8 forms: W-8BEN, W-8BEN-E, W-8ECI, W-8EXP and W-8IMY. This article will walk you through the process of filling out the W-8BEN form with a practical example for a non-U.S. IT professional working overseas.

When Are These Instructions Relevant to You?

Suppose you are an international contractor, such as an engineer or quality assurance analyst, who does not live in the United States but performs services for a U.S. company. In that case, you must submit the W-8BEN form to your overseas partner/client.

Consider the following statements to be confident that the instructions for the W-8BEN form apply to you:

- You ARE working as an individual or as a sole proprietor.

- You are NOT a U.S. citizen.

- You are NOT living in the U.S.

- You DO perform services outside the U.S. (your workplace is NOT in the U.S.).

- However, you DO receive your income from a U.S. company.

Were you able to confirm everything above? If so, you should go ahead and submit the W-8BEN form to your client as soon as possible. If the first statement doesn’t apply to you and you own or work for a company like LLC, make sure to follow us. We are preparing a separate article to guide you through the W-8BEN-E form applicable to you.

How to Fill Out a W-8BEN Form in This Case?

With the W-8BEN form, the IRS wants you to explain whether your income from a U.S.-based company is U.S.-sourced or not in order to determine whether your income should be taxed or tax-exempt in the United States. Even so, it can be challenging to understand what you need to fill out on the form exactly.

To help you with that, let's first remember we have already clarified that your income is not U.S. sourced. We have done so by confirming all the statements above. If you still have any doubts about it, go back to the first article of the W-8 Forms series to learn more about this rule.

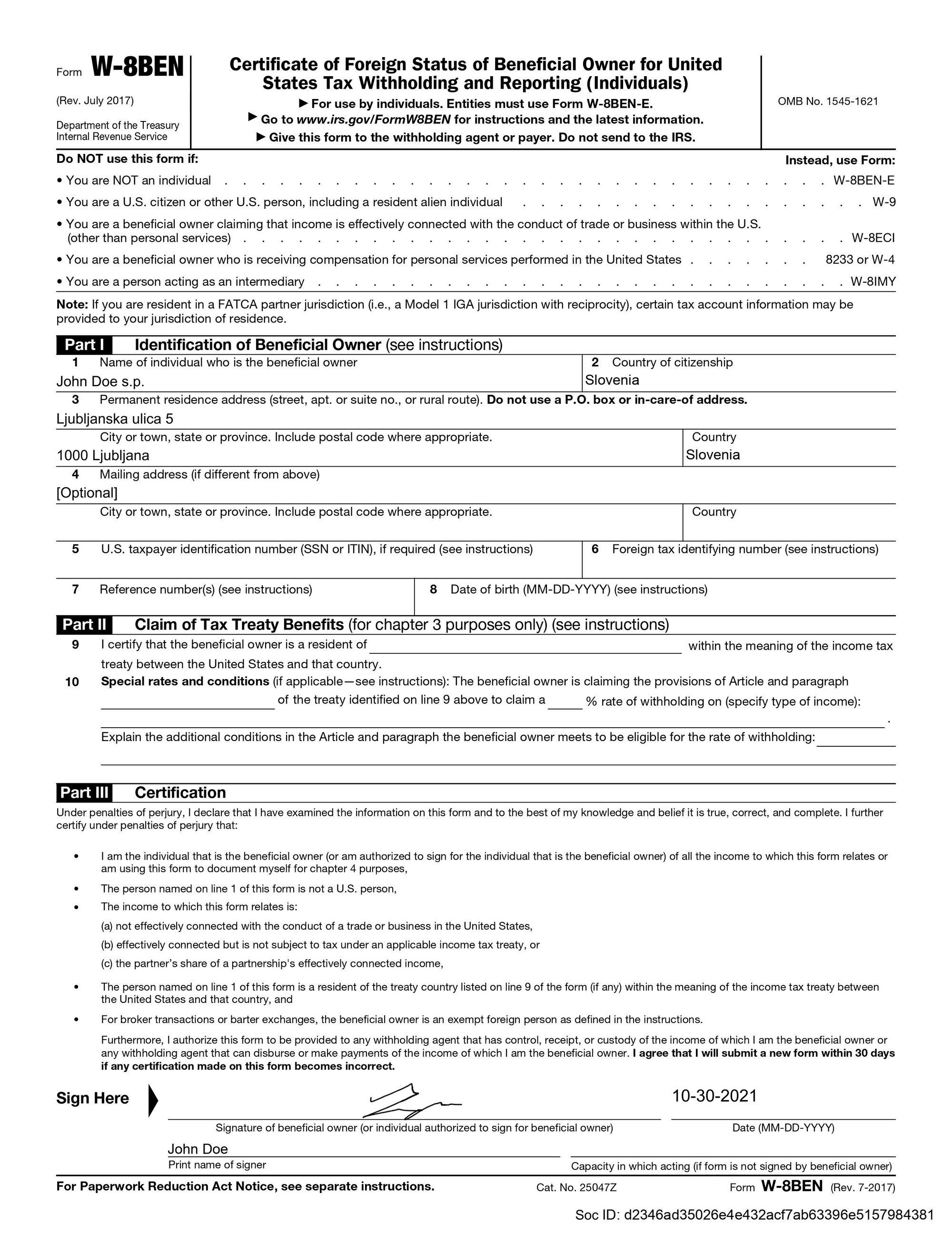

Secondly, when it comes to filling out the W-8BEN form, not having your income sourced from the U.S. means that you must fill out the following sections:

- Part I/1

- Part I/2

- Part I/3

- Part I/4 (optionally - only if your mailing address is different from your residence address)

Moreover, Part II is left blank.

Finally, in Part III, you check the box that says, "I certify that I have the capacity to sign for the person identified on line 1 of this form." The signature, date in the U.S. format MM-DD-YYYY (first the month, then the day) and the signer's print name must also be added at the end. An example of a completed W-8BEN form for a foreign contractor who does not reside in the United States is shown below.

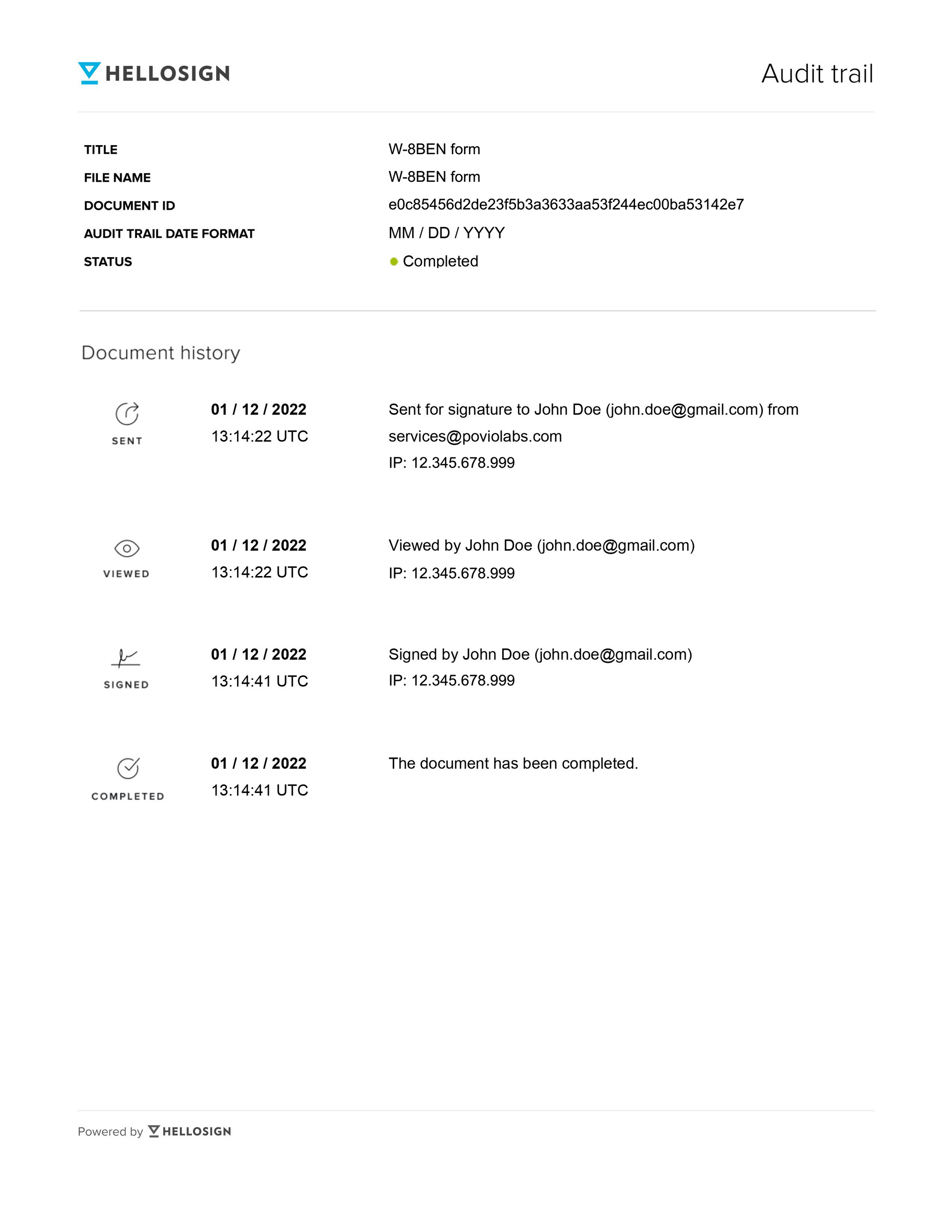

Before finishing, consider one more thing if you intend to sign the W-8BEN form electronically. IRS allows electronic signatures that have additional information included that support the validity of it, such as:

- signer's email address

- date and time of the digital signature

- a statement that the form has been electronically signed

To help yourself, you can use a third-party tool to submit an electronic signature. In this case, the tool will automatically include the mentioned information. Below is an example of a verification page if you’ve done your signature with the HelloSign.

How Long Is the W-8BEN Form Valid?

Unfortunately, the W-8BEN form has an expiration date. It is critical to remember that the submission will be valid for the year you signed it in and the next three calendar years. As a result, your form will always expire on December 31st.

For instance, let’s assume you submitted and signed a form on the 30th of October 2021. In this case, your W-8BEN will be valid until December 31, 2024. After that, you'll have to go through the process again.

Aside from the form's expiration date, another reason you might need to fill it out and sign it again is if any of the information on it changes. One example of this would be relocating and getting a new address.

-------------

This is the second blog post in the series 'W-8 Forms Made Simple’, containing all of the information you need to fill out a W-8BEN form if you are a non-U.S. IT professional working overseas. See the first article in the series for more general information on how, why, and when an engineer should file a W-8 Form:

Next articles (coming soon):

- How Should An Engineer Fill Out W-8BEN-E Form?

*These rules do not count as legal or tax advice. A person must contact legal or tax professionals to verify their accuracy. Povio, Inc. nor the author herself accept no material or legal responsibility for the content of the following rules. Consult with a certified tax advisor or check the official IRS instructions if in doubt.